Investment Advisors Things To Know Before You Get This

Table of ContentsHow Investment Advisors can Save You Time, Stress, and Money.Some Known Facts About Investment Advisors.Investment Advisors Fundamentals ExplainedRumored Buzz on Investment Advisors

This is actually certainly not a deal or even offer in any territory where our team are certainly not accredited to perform organization or where such promotion or even offer will be actually contrary to the neighborhood rules as well as policies of that territory, including, however not limited to persons living in Australia, Canada, Hong Kong, Asia, Saudi Arabia, Singapore, UK, and also the countries of the European Association - investment advisors.Retirement implies different factors to everybody. It might be actually a definite aspect in time when you quit work, as well as begin a brand-new stage of life.

Discover out when and exactly how to access your extremely, after that explore your retired life revenue choices. Or take into consideration a switch to retired life technique.

What Does Investment Advisors Mean?

Evaluate up the benefits and drawbacks if you're thinking about downsizing your house, or even a reverse mortgage loan or property equity launch item.

Circulations from previous employers' retired life strategies may be actually spun over to the SRP. The Educator Insurance Coverage as well as Annuity Association (TIAA) is actually the single service provider of recordkeeping companies for the Retirement Planning accounts.

With dollar-cost averaging, you normally get fewer portions when the marketplace is actually higher and more allotments when the market is actually reduced. This organized strategy can assist you steadily construct riches through transforming the rates at which you acquire additional shares of a supply. (Neither cost gain neither income is actually guaranteed, nevertheless.) It's a way to hedge the danger of getting extremely considerably at higher prices and also inadequate at low rates.

Investment Advisors Things To Know Before You Get This

If you perform this prior to you get utilized to possessing the added earnings, you may not even observe a variation. You can withdraw loan coming from an IRA account before you meet grow older 59, it is actually usually certainly not a really good concept. For starters, you'll need to pay out income taxes and also probably a 10% internal revenue service very early drawback penalty on earnings and pre-tax contributions you remove.

Determine just how an advisor can easily partner with you when you're retired to help you choose to fulfill your income, insurance coverage and helpful site investment necessities.

Listed below's exactly how it operates: Allow's state you possess $160,000 to commit. If you choose to use a CD step ladder, you could possibly put $40,000 in a 12-month compact disc, yet another $40,000 in a 24-month compact disc, as well as the same in 36- and 48-month Compact discs. After the very first 12 months, you may either utilize the cash coming from the 12-month compact disc or reapportion it to a 48-month compact disc to always keep the ladder going.

If you appreciate your present project, you could explore staying on the crew, just in a part-time part. That way you can remain to check over here obtain the fulfillment and satisfaction that your job offers while not endangering the flexibility you wish away from retirement life. Or even, if you would certainly favor to leave your present business, you might explore other part-time projects in industries that fascinate you.

Some Of Investment Advisors

A (Lock A locked padlock) or https:// why not look here indicates you have actually properly hooked up to the. gov web site. Share delicate information only on representative, secure web sites (investment advisors).

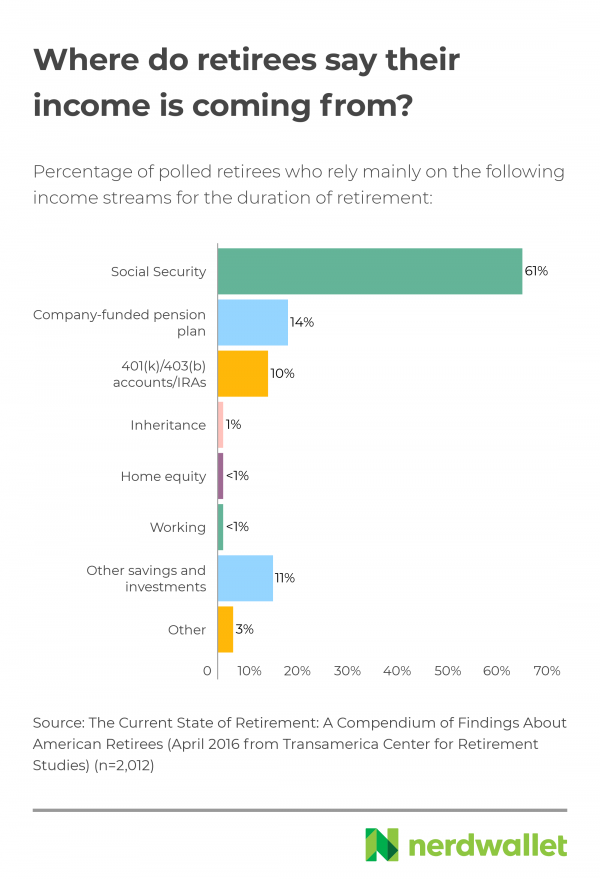

This is actually a foundational income source for many people. When you choose to take it may have a significant influence on your retirement life. It may be alluring to state your advantage as soon as you are actually entitled for Social Securitytypically at age 62. But that may be a costly technique.